An exciting yet scary realization for people in commerce is the fact that Black Friday is just around the corner. Taking place on November 26 2021, with Cyber Monday following three days later, this particular Black Friday and Cyber Monday period is special, as it is the second edition of the big retail season happening during the coronavirus pandemic.

This means digital sales are expected to still play a main role but, unlike last year, brands and retailers will no longer be second-guessing whether their strategies will work in “unprecedented times”. They’ll no longer be wandering into uncharted territory. This time, they can make informed decisions based on what worked previously and also accurately forecast what is to come for their online businesses.

To help out in that regard, we gathered some Black Friday statistics so that they know what to expect in 2021.

We can all easily picture the traditional Black Friday atmosphere: arriving to the store in the early morning and sometimes even the night before; never-ending queues; and lots of people set on scoring the greatest deals, the so-called “doorbusters”. These discounts are fittingly named given they were so good that shoppers actually busted doors down to get to them first.

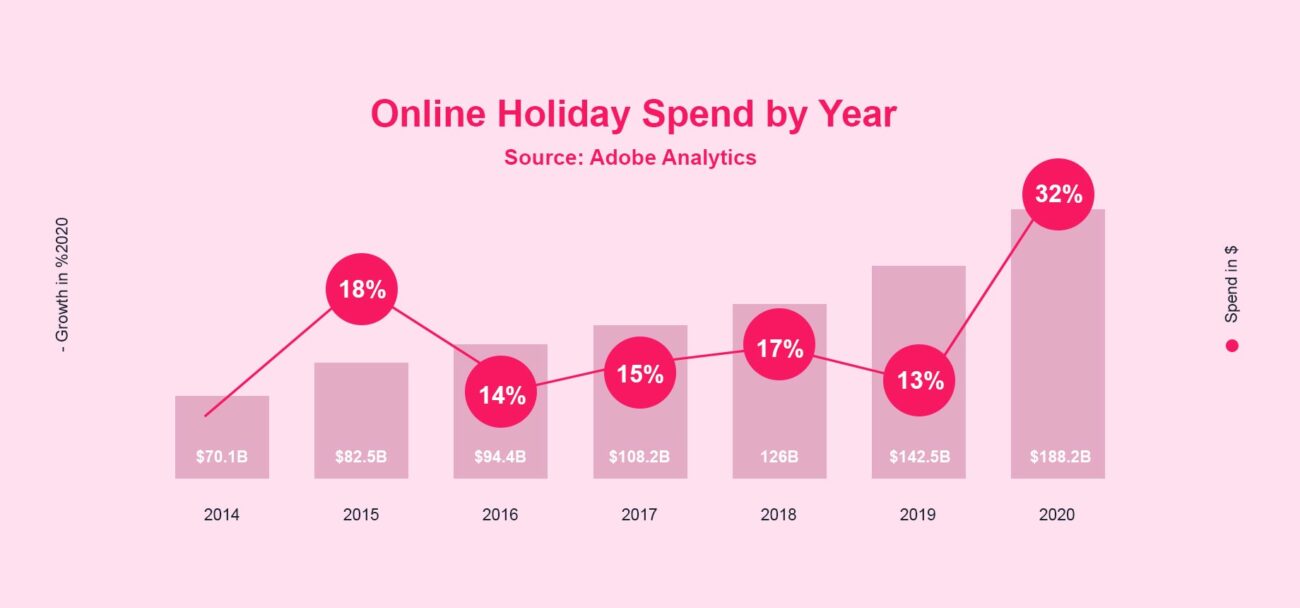

But what had been historically an in-store shopping experience has recently migrated online. Online Black Friday and Cyber Monday sales have been on an upward slope since 2016 and, even before the pandemic, shoppers started to favor digital shopping. For instance, in 2019, the National Retail Federation reported that more Americans shopped online than in physical stores.

The online is winning against brick-and-mortar stores due to several reasons.

This is a trick that plenty of retailers have used to decongest their physical stores, because the online space can be increased and decreased at will, whereas a store usually remains with the initial square footage.

The growth of ecommerce in general can be correlated with the popularity of the internet across the world. The number of global internet users is steadily growing, as is the global smartphone penetration rate. With ecommerce often being regarded as the more convenient and speedy shopping alternative, it should come as no surprise that Black Friday has been digitalized, too.

The nail in the coffin of brick-and-mortar has been, unsurprisingly, the coronavirus pandemic. After an almost completely digital edition in 2020 due to local lockdowns, 2021 looks to be better for physical merchants, but retail won’t revert back to pre-pandemic ways.

On the one hand, foot traffic analysis in previous months shows a great increase in mall visits. On the other hand, Delta variant concerns and growth in cases have pushed some physical stores, like Walmart, to announce their closure during Black Friday, all in the hopes of safer shopping. Likewise, customers are still reluctant to shop in-store when massive crowds are usually expected.

Additionally, the pandemic has forced lots of people to try out online shopping, either for the first time or on a more frequent basis, and they’re unlikely to suddenly stop. All these irreversible changes make the case for digital overpowering brick-and-mortar for a good while from now on, perhaps forever.

Globally, revenue from online sales increased by 36% in 2020. In the US specifically, online spending on Black Friday reached $9 billion USD, growing by 22%, and $14 billion USD for the entire Black Friday weekend. Overall, the 5-day Black Friday and Cyber Monday period brought in around $34 billion USD, accounting for 18% of total online sales for 2020.

However, an important thing to keep in mind is that in 2020, discretionary spending fell sharply — shoppers spent $312 on average compared to $362 in 2019. But the economy is slowly recovering right now, so people expect to spend even more this year and dig into COVID-19 savings or resort to Buy Now Pay Later (BNPL) financing options. The industry is expecting a 20% Year-over-Year growth for this year’s online sales.

The race is not finished when the clock hits midnight and Black Friday officially ends. Seasoned commerce businesses know that Cyber Monday is, perhaps counterintuitively, the bigger threat. Both in 2019 and 2020, Cyber Monday sales outpaced Black Friday ones thanks to better discounts, thus crowning itself as the largest digital sales day ever, at least in the history of the US and the UK (Chinese big retail events like Singles Day far surpass it, though).

But from Cyber Monday to Christmas is just a little hop, so retailers have started stretching BFCM till the end of the year, both online and offline – and sometimes beginning weeks before Black Friday. In Brazil, retailers have adopted the so-called Black November, with discounts being offered and promotions happening throughout the whole month.

Retailers are hyping up discounts using a “spread-out” approach which in turn facilitates a safer shopping experience in person and reduces the odds of shipping delays when you order online.

Overall, the entire holiday shopping season, starting from Thanksgiving Day, is the most demanding period of the retail year: 20% of all retail sales occur from November to December, largely driven by Black Friday, Cyber Monday and Christmas.

According to SEMRush, YoY growth in searches for the “Black Friday” terms grew significantly globally in the last few years. For example, in the US, between 2017 and 2018, there was an 8.71% growth, followed by a dip of 4.59% between 2018 and 2019, which was then topped off by a phenomenal 34.13% YoY growth last year. 2021 searches will most likely not grow at the same rate, but an increase brought on by the pandemic effect will ensure positive trends.

In terms of regional interest for Black Friday 2020, Brazil led the way with a YoY growth of 48% in search interest, with the US and Canada battling for the title of second most engaged nation around the 34% mark. But with Latin America currently being the fastest-growing regional retail ecommerce market according to eMarketer, retailers having operations in the area will likely benefit from this growth in 2021 and the years to come.

The SEMRush analysis also looked at the Top 3 product groups and Top 3 products creating a frenzy during BFCM. Laptops, TVs and Microwaves were the most popular categories and Nintendo Switch, PlayStation and Apple AirPods were the bestselling products, continuing the year-old evidence that more expensive tech products have always been and will always be the main attraction of the event.

Yet consumer electronics are not everything on the table. Fashion retailers have also been bringing out the big discount guns and some voices say toys are not to be dismissed either. Home decoration, especially with holiday gatherings finally making a safe return, will likely be another contestant for the popularity prize.

The most interesting findings and forecasts of them all, however, are the grocery and CPG industries. According to Adobe Analytics, online grocery shopping on Black Friday 2020 surged 397% compared with October daily averages, once again in great part due to COVID-19. Similarly, personal care sales increased by 556%, while pet products rose 254%. In 2021, these categories are bound to be winners yet again.

During the entire BFCM period and the holiday season of 2020, online traffic and spending amassed per type of device reached the following figures:

The metrics above showcase the consumer tendency to browse via mobile devices and complete the purchase on the desktop environment, perhaps due to a sense of security and comfort. Nonetheless, this status quo goes to show two important facts.

Firstly, customers are omnichannel, they expect to switch from one medium to another with ease mid-way through the shopping experience. This means that online businesses should also be omnichannel. Just the mere possibility of adding items to the cart while on mobile and then completing the order on a tablet without losing the cart is highly welcomed by convenience-driven shoppers, as is the option to buy online and pick-up in-store.

Secondly, even though desktop still reigns supreme in terms of revenue, a mobile shopping experience is increasingly important and, dare we say it, a must-have. In addition to the aforementioned stats, it’s worth mentioning that mobile shopping had a 15% higher conversion rate in 2020 and the trend is likely to continue in 2021 according to growing mobile usage data. This means mobile web pages and mobile applications need to be prepared accordingly when it comes to UX/UI and page speed needs to be lightning fast.

Some of the most hectic days of the year will arrive in a matter of weeks and retailers and brands need to take advantage of everything at their disposal to come out on top of this Black Friday. Insights garnered from last year and final numbers shed some light on what to pay attention to. One thing is more than clear, though: ecommerce will be indispensable.