After more than a year since the global health crisis began, saying that the coronavirus pandemic changed our lives and the way we shop rings like a truism. Nevertheless, we sometimes do not realize the full extent of these changes, not unless we analyze and gather them in one place. So here’s a rundown on why the grocery industry, an essential part of our society, will never be the same again.

Before we delve head-first into the nitty gritty, let’s get a grip on the pre-pandemic context. The grocery industry, much like any other one, was on its way to experiencing a digital transformation, albeit slower. According to Statista, in 2018 the online grocery market share in the US was merely 2.7%. In 2019, that figure slightly increased to 3.4%. Comparatively, ecommerce in the fashion industry had a market share of 16% and 19%, respectively, for the same period.

Why that lag? Well, the grocery industry has been, is and will be, at least for the foreseeable future, dominated by physical shopping. For instance, many customers prefer to touch and see the fresh produce and handpick items with the best expiration date (we’ve all done it). They also appreciate having store assistants close-by and munching on free samples. Simply put, a ride to the grocery store can be an intrinsically pleasant experience of crossing off the items you need, finding things you didn’t even know you wanted, hunting the greatest and latest bargains and, according to a Google & Bain whitepaper, just browsing aisles. Consequently, for many decades, in-store grocery shopping has been a strong pillar of societal activities, which is why it hasn’t suffered many changes along the years.

However, regardless of a preference for traditional commerce, the truth remains that the online share of the industry has been steadily growing the past few years. This is happening for a number of reasons.

On the one hand, there’s the natural correlation with the rise of the internet and of smart devices which has slowly but surely boosted digital commerce in all areas. Additionally, digitally-native generations (Millennials, Generation Z and whatever comes next) are set to become the majority of the worldwide population soon enough, with an amazing purchasing power that is skewed towards the online medium.

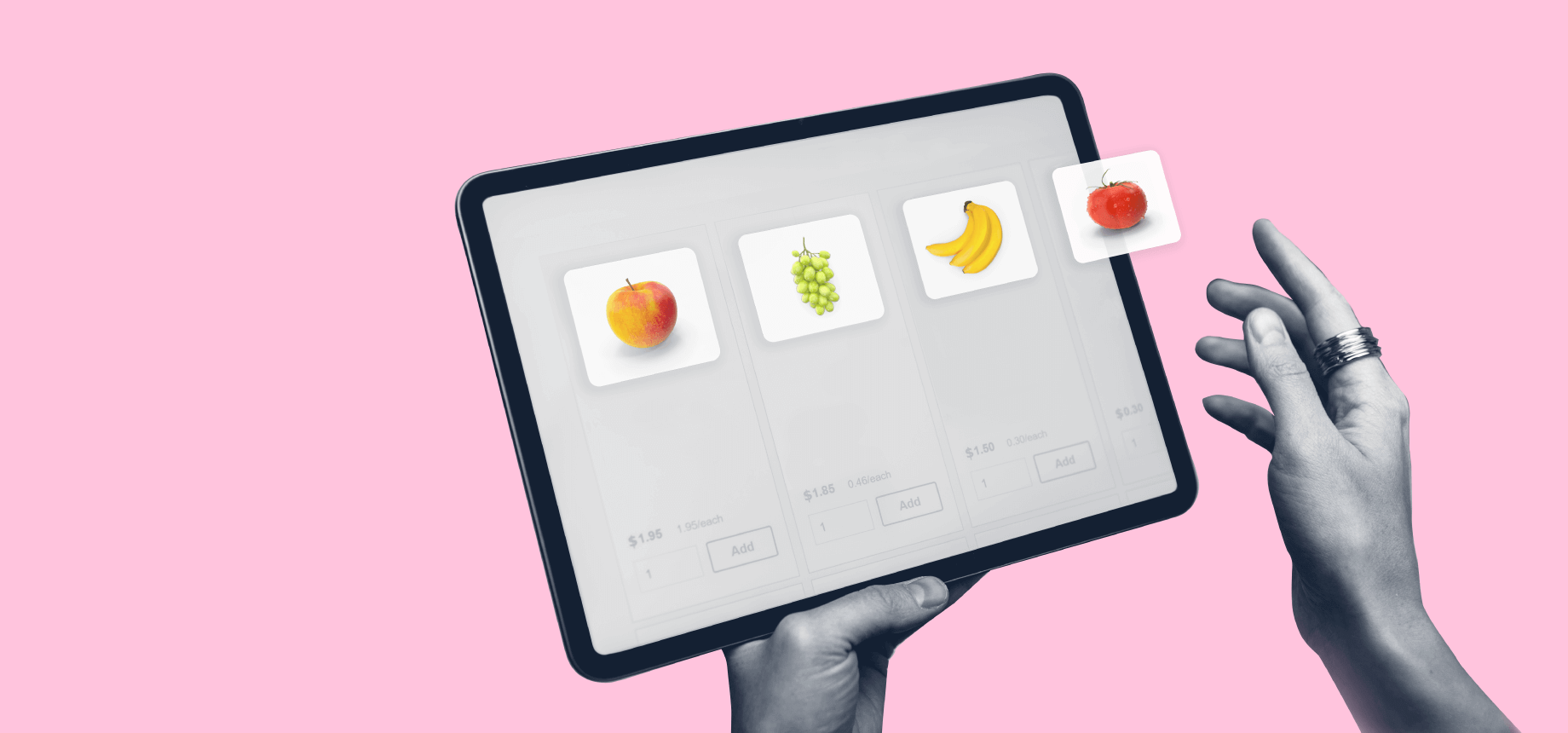

On the other hand, digital commerce generally tempts today’s society through convenience and speed. This allure grows tremendously for an industry like grocery, which is significantly inconvenient and time-consuming. You know how it goes: browsing the store endlessly to find every item on the shopping list, dealing with unexpected store layout changes and impatient children, bumping into armies of people, waiting in line for the checkout, carrying enormous bags home through pouring rain or being stuck in traffic. By shopping for groceries in physical stores, you’re also more likely to overspend: you don’t have a real-time calculator of your cart like you do if you opt for digital commerce; unless you do the maths as you go, you’ll only know your verdict at the checkout.

Historically, in-store grocery shopping has been regarded as a pleasant experience and it definitely still retains its perks, but a cost-benefit analysis of whether or not to shop in-store now takes into account different parameters. Today’s shoppers value time above all else and demand a hassle-free shopping experience. A good grocery ecommerce operation can easily meet those requirements through flexible fulfillment options, effortless repurchasing methods and automatic subscriptions, among many other functionalities.

In 2020, the online grocery market share jumped to 10.2%, equivalent to a 200% YoY growth rate. But how come there was such a big jump between 2019 and 2020, even accounting for COVID-19? If you actually think about it, grocery stores were considered essential in most places and so they could evade lockdown-imposed restrictions, unlike fashion stores who had a completely different fate and had to adapt in order to survive. So what exactly happened?

It all boils down to safety. In those incipient stages of the pandemic, when uncertainty reigned supreme, many people felt safer not to go out to the nearest grocery store, even if it was open. They felt safer not to touch so many items, not to browse so many aisles and not to meet so many people on their way to and from the store, a sentiment that holds true even today. Coupled with general lockdowns and the recommendation to stay inside, the predictable happened: online demand skyrocketed. Emarketer reports that, in the US alone, there was an increase of 41.9% digital grocery buyers compared to 2019; household penetration also rose up to 35% and monthly order frequency to 1.9 per active customer. Online grocery shopping became the first buying option among many customers.

Consequently, online grocery stores couldn’t keep up with that unexpected and unbelievable surge in demand. For example, Ocado, a digital pure grocery player, reported tenfold increases in demand and a web traffic equal to 100 times the pre-pandemic level. Entire sites broke down and, for the majority of the chains, the promised next-day delivery became a two-week delivery overnight. Amazon Fresh and Whole Foods had to resort to waitlisting customers signing up for grocery delivery while they increased their capacity, much like all other supermarket chains. Tesco, UK’s largest grocery chain, more than doubled its capacity up to 1.5 million orders per week and so did Sainsbury’s.

All in all, such a show of force was neither an easy operational feat, nor cheap, as it also called for extra human resources (e.g. pickers to assemble orders and drivers to deliver them). In fact, the entire transition towards the online realm, despite necessary, was noted with deep concern, because it is colloquially known as the least profitable channel in the grocery industry, an industry plagued by smaller margins by default.

The alternative of not jumping on the digital bandwagon, however, would have been far more disadvantageous. Overall, grocery chains which already had online operations highly benefited from the situation, despite being strained by the new status quo. By comparison, grocery chains without ecommerce struggled with the decision of whether or not to go online. The ones vying for the switch wanted to do it as quickly as possible not only come to their customers’ aid, but also to take advantage of the momentum and to not lose ground in front of competitors. Calimax over in Mexico, for instance, achieved that in just four weeks.

Generally, grocers with an in-store picking model (as opposed to hybrid or pure players relying solely on fulfilment from a distribution center) found it easier to match the bloated demand due to low CAPEX and a shorter drive duration. However, there are some limitations: picking capacity is curbed by shoppers being present in the store, not to mention by a labyrinthine layout designed for aimless wandering in the hopes of impulse purchases. Some grocery chains, like DIA over in Argentina, realized that early on and pivoted quickly by transforming a number of their locations into so-called dark stores. Dark stores are mini distribution centers functioning 24/7 for picking up online orders, closed to the public for more efficient picking and strategically placed in high-density areas to offer speedier order fulfilment. The idea was not exactly new – Target and Walmart were trying this even before the pandemic – but it gained popularity and relevance in 2020, temporarily unburdening some grocers.

In addition to scaling delivery capacity, fulfilment options also diversified. Some grocery chains implemented pick-up in-store and curbside pick-up, a move largely upheld by having an omnichannel strategy and technology. Logically, with more possibilities came more growth – but just how much that growth would have been if the grocery industry had been fully prepared beforehand will remain an intriguing mystery.

But the entire grocery industry was bombarded from all angles, not just the online share. Safety measures had to be taken especially in-store, causing operational shuffling and immense costs that diminished profits – for UK’s Morrisons, those amounted to £155 million GBP. A sweet side-effect of this operational layer was that it showed commitment to the consumer’s needs, winning brownie points for the long-term – customers are more inclined to shop if they feel the business is taking appropriate safety precautions.

Whenever people did choose to bravely shop on premises, the majority let go of long-held allegiances to their favourite grocery store and instead flocked to the nearest one. Shoppers decreased the number of trips they would take, electing to get more items at once, which implicitly increased the average value of a basket. The diversity inside the cart diminished as people prioritised necessities, but the frenzy of stockpiling eventually triggered low stock for certain SKUs (e.g. flour, pasta, toilet paper), as well as the reverse side of the coin: the constant need for restocking. The change in consumer behavior prompted heads of grocery stores to focus their energy mainly on restocking best-selling items, which led to an overall reduction of SKUs both offline and online, the latter being around 21% globally according to Euromonitor International.

Additionally, due to the closure of restaurants, consumers had to retreat to their own kitchens. Ultimately, these new circumstances meant more money spent on groceries in 2020 than in 2019. In the US, spikes in spending were the highest in the month of March, when the YoY difference amounted to over 30%; gradually, in the span of a few months, the difference trickled down to 10%. After the initial period of hoarding, most countries have stabilized the growth of the grocery industry somewhere between 5-10%.

Nonetheless, despite increased cumulative spending, individual consumer behavior paradoxically became more cautious. Discounted items rose in popularity and, according to McKinsey, people used shopping lists more frequently to reduce impulse buying, a demeanor triggered by the unstable economic climate and the precarious labor market created by the pandemic.

Looking towards the future, Statista shows that the online grocery market share, while not yet a big chunk of the overall grocery retail market, is growing at a phenomenal rate. Indeed, estimates for 2025 predict 21.5% of the grocery market will be rooted in digital commerce, meaning that no big grocery player will be able to elude digitalization further – not unless they want to lose market share.

But, why? Why such a great growth? Won’t the people that temporarily set out to do their grocery shopping online for the sake of safety automatically and completely revert to traditional shopping once the world goes back to “normal”? Won’t the digitalization of the grocery industry regress back to a snail’s pace?

Well, no – and there are at least three reasons why.

All in all, digital grocery buyers are here to stay – and they say so themselves. Out of the tens of thousands of customers who shopped for food online at Waitrose in 2020, for instance, more than 70% declare they’ll continue to do so after the pandemic. Likewise, grocery chains are still increasing their delivery capacity and making permanent moves towards dark stores. And while we leave how the future of grocery will actually look like for another conversation, it comes as no surprise that the future will be vastly different and highly digitalized. COVID-19 has indeed forever changed the grocery industry.

Grocery ecommerce platform pros and cons

Online grocery platform explained