When Buy Now, Pay Later (BNPL) solutions started making waves a few years ago, retailers wondered if a new trend was about to appear. Nowadays, they’ve got their answer, as it is a true payments phenomenon. So let’s dive deep into what exactly powers its rise to stardom – and why merchants are right to take notice of it.

BNPL allows shoppers to buy something, most often online, only to pay for them later on, either in full or in installments, with no interest for short-term financing. The important difference when compared to the traditional layaway plans used in retail, however, is that the order is dispatched in a business-as-usual manner, right after being placed, not after the entire price is paid.

But the win-win aspect of it is that retailers get paid in full, upfront payments – minus a fee charged by the provider in exchange for enabling the payment method. That fee can range from anywhere between 2-8%, depending on the solution and the merchant, item type and price of item. Some services also charge a flat rate.

All in all, those fees seem like a small price to pay (pun unintended) to take advantage of its increasing popularity. Currently, it is the fastest-growing way to pay in the developed world, vastly overtaking the growth rate of traditional bank transfers and of digital wallets the likes of Apple Pay, Google Pay and Samsung Pay. Most-known players on this market are Klarna, Clearpay (named Afterpay in AUS and NZ), Affirm, LayBuy and Quadpay, but giants like PayPal, Citibank, American Express and Visa have recently been responding to the fintech challengers with similar options of their own. This space is about to become even more competitive.

Now that we’ve got the basics covered, it’s time to get acquainted with the details – lots of perks for both customers and retailers await.

Buy Now, Pay Later might be skyrocketing, but it’s important to understand the underlying trends and behavior powering that rise – why do consumers love it so much?

The use of this payment method is highest among the younger demographics, namely Millennials, with 54% of them using it, and Generation Z, with 50%. Of course, the trend can be correlated with these generations’ digital nativity, but older generations are gradually embracing it as well, so there are definitely other factors driving people towards it.

Here are three of them.

With no interest accumulating on deferred payments, oftentime no upfront payments and only the risk of some late-payment fees, this new payment trend is a consumer-friendly form of credit. It can be used to spread over the costs of items ranging from the most basic necessities to more expensive, high-value ones.

Implicitly, it can help throughout uncertain financial times, perhaps its most important value proposition. This scenario was evidently seen throughout the COVID-19 pandemic, when the prospect of job and salary cuts forced shoppers to decrease their spending and adopt a more cautious approach to shopping.

Thus, the global health crisis brought forward a need for flexible payment options that come to the aid of the shopper – and this one certainly fit the bill. Over half of users used the payment method more during the coronavirus pandemic and general use almost quadrupled in 2020.

Another positive aspect of this type of solutions is that they can propel people towards an eco-friendlier lifestyle. As more and more shoppers, especially those in younger cohorts, are becoming conscious of the environmental implications tied to their shopping choices, this later payment method can be used to buy fewer yet better-quality items. That way, the high price tag often associated with good value would no longer be a blocker in the journey towards sustainability.

Millennials and Gen Z consumers, known to be more risk-averse when it comes to financial planning, are shunning away from credit cards and the associated hard-to-decipher terminology, plans and fees. Shoppers feel like options of paying later offer incredibly more spending control, with no hidden fees, easily understandable short-term repayment plans, digital reminders and an overview of all purchases and deferred payments.

Likewise, the same shoppers vying using this alternate form of payment are the ones most accustomed to monthly subscriptions (e.g. grocery subscriptions), so splitting payments for shopping, too, would fit right in with their preferences. They can substitute peaks of unforeseen spendings with smaller and fewer installments for a smooth consumption across time, while also gaining visibility over upcoming payments. In a nutshell, predictability eases their minds.

Research from Finder highlights that the top reason such a payment alternative is used for is its ease and convenience. There are no lengthy and bothersome credit checks and the payment method is seamlessly integrated inside the buyer’s journey and checkout experience. Therefore, the shopper does not need to disrupt their shopping session and apply for financing elsewhere.

Smaller convenient benefits include the fact that customers can try on and check out their items before fully committing, either by deferring the full payment to a later date or by opting for installments.

After the analysis above, it should come as no surprise that, in exchange for some fees, retailers can significantly increase revenue from two sides: more sales (derived from higher conversions and fewer abandoned carts) and higher AOV.

Buy Now Pay Later has become such a differentiator that some customers, due to any of the three reasons mentioned above or others, will not place the order if it is not available. Simply offering it will increase the odds of converting, too, with 42% of Generation Z shoppers and 69% of Millennial shoppers being more likely to finalize the buying journey if this service is offered, according to Afterpay.

But this option is being used not only to split payments in multiple, more manageable bits, but also to increase how much one spends per purchase. According to Cardify.ai, 49% of people are spending anywhere between 10-40% more with these services than they would otherwise spend on credit cards.

It is also a thrifty way for retailers to push out old stock and gain valuable customer insights on spending preferences, not to mention garner brand loyalty if they are championing responsible consumerism. The era of brands with a purpose is here and winning shoppers’ trust through methods they approve of is key.

Speaking of winning trust, BNPL providers do not sit behind the retailer. Instead, they are approaching consumers directly to establish themselves not only as secure payment alternatives, but also as trustworthy brands. They each tend to invest significantly into brand building and marketing campaigns, which means retailers have an opportunity to piggyback on their efforts, obtaining free marketing and an indirect stamp of approval.

Simply put, some of the perks for businesses, should they take up the offer, are:

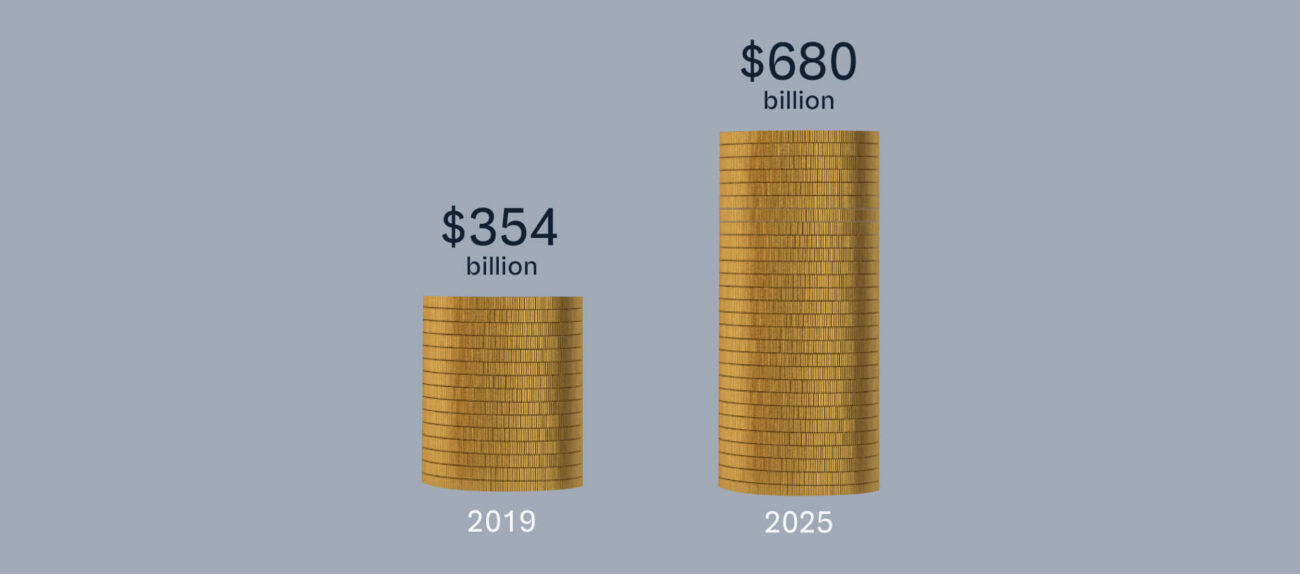

The BNPL future looks bright! While the payment option might not be growing at the same rate after the pandemic as during it, when both the explosion of ecommerce channels and the turbulent economic climate catapulted it to new heights, a substantial boom of the market is still expected. IBIS World predicts the industry revenue will grow at 9.8% annually over the next five years, eventually exceeding $1 billion USD. Additionally, BusinessWire expects digital spending through these services to reach $680 billion USD by 2025, which equates to a 92% increase over 2019 figures.

The already significant number of shoppers and retailers using it will also increase. Klarna, for example, has 87 million global active users as of February 2021, with more than 17 million of them originating from the US and another 14 million from the UK. The headcount for retailers is equally astounding: 200,000 worldwide.

Furthermore, while right now most purchases are related to apparel & accessories, the bold promise of this trend goes way beyond this particular segment. Solutions could help people smooth their spending for healthcare, holidays, home improvement and electronics, just to name a few.

Another interesting development we’ll probably see is an omnichannel application. As the retail environment embraces omnichannel due to a better customer experience that drives greater revenue, BNPL can power that switch further, with options like buy online and pick-up in-store, buy online and in-store returns, or even buy in-store and ship-to-home. Indeed, part of the same omnichannel rationale is extending later payments to in-store purchases. As mentioned in the beginning, this form of credit is now mostly used in digital stores, but some retailers have also implemented it inside their brick-and-mortar locations, a decision that is likely to become more popular – benefits would be then expanded across the entire retail operation, not just the ecommerce part.

Providers are also expected to go into proper banking territory. For instance, Klarna became a licensed bank in Europe and has its own loyalty programme and a shopping feature that offers the same payment options for all purchases made through its app, regardless of whether a merchant works with Affirm directly. The intersection of banking and shopping is here to stay.

Worthy of note is the fact that more regulation is bound to happen after concerns of young customers overspending. In the UK, changes to legislation will aim to provide greater protection for consumers, with retailers unable to offer these options unless they’re authorized for credit broking. But the vast majority of transactions are originating from large retailers, which either already have or can easily obtain the authorization. It goes without saying that the age of digital payment methods has arrived.

Recognizing that more and more retailers desire to attune their businesses to the needs of the modern shopper by offering these payment options, VTEX and Klarna recently partnered to make online shopping smooth in Europe and the US.

Major brands and retailers using the VTEX Commerce Platform can now enable the Klarna Pay Now and Klarna Pay Later payment methods on their ecommerce stores with just a few easy configuration steps. Options vary from instant payment and payment in 30 days to 3-4 interest-free installments or even financing the amount up to 36 months – all whilst keeping retailers secure with full upfront payments. Smooth!